The 7 Best Online Payment Options for Contractors

Small business payment options can be confusing. As a contractor, you need to consider different factors when choosing payment methods. You want your clients to have as many choices as possible. At the same time, you need to ensure each method is secure and doesn’t bring excessive fees.

Convenience and choice for your customers are important. However, you should be comfortable with the choices you offer. The first step in choosing the right way to pay is to understand all the possibilities.

In this article, we will explore the importance of choosing the right payment options. You’ll learn about traditional and modern methods. The article will also discuss how you can ensure prompt payments. Finally, we’ll offer tips for choosing the best payment options for your business.

RELATED ARTICLE: Accepting Credit Card Payments as a Home Service Contractor

Why Payment Options Matter for Contractors

Contractors often have to deal with late payments. One 2023 industry survey found that 72% of contractors had payments delayed for more than 30 days. And 11% had to wait more than two months.

Offering your customers more payment options could help combat late payments. Here are the reasons you should carefully choose the right methods for your business:

- Convenience for customers: The more options you have, the easier it is for customers to pay. They can simply find the method that works best for them. You avoid forcing them to use a form of payment that isn’t easily accessible.

- Better cash-flow management: More options can lead to faster payment. You don’t have to wait while customers arrange an acceptable form of payment. The increased speed gives you consistent cash flow. This allows you to cover costs and pay subcontractors without financial strain.

- Gaining a competitive advantage: Customer satisfaction from payment convenience helps you stand out. Some clients may choose you because you offer their preferred payment method.

- Adaptability to market changes: Embrace new payment methods early. If you do so, you’ll be ready when they become more popular. For instance, you can take advantage of trends like payment apps.

- Improved customer relations: Customer relations go beyond convenience. Some clients may appreciate your attempts to accommodate them. Your customer-friendly image can lead to more referrals and positive reviews. These could bring more clients in the future.

These benefits require offering both traditional and modern payment methods.

RELATED ARTICLE: How to Invoice for Handyman Services

Traditional Payment Methods

Traditional payment methods are still popular. Market research firm YouGov found that 67% of Americans still use cash for some purchases. You still need to accept cash, paper checks, and bank transfers. Depending on your clients, these may be the main payment sources.

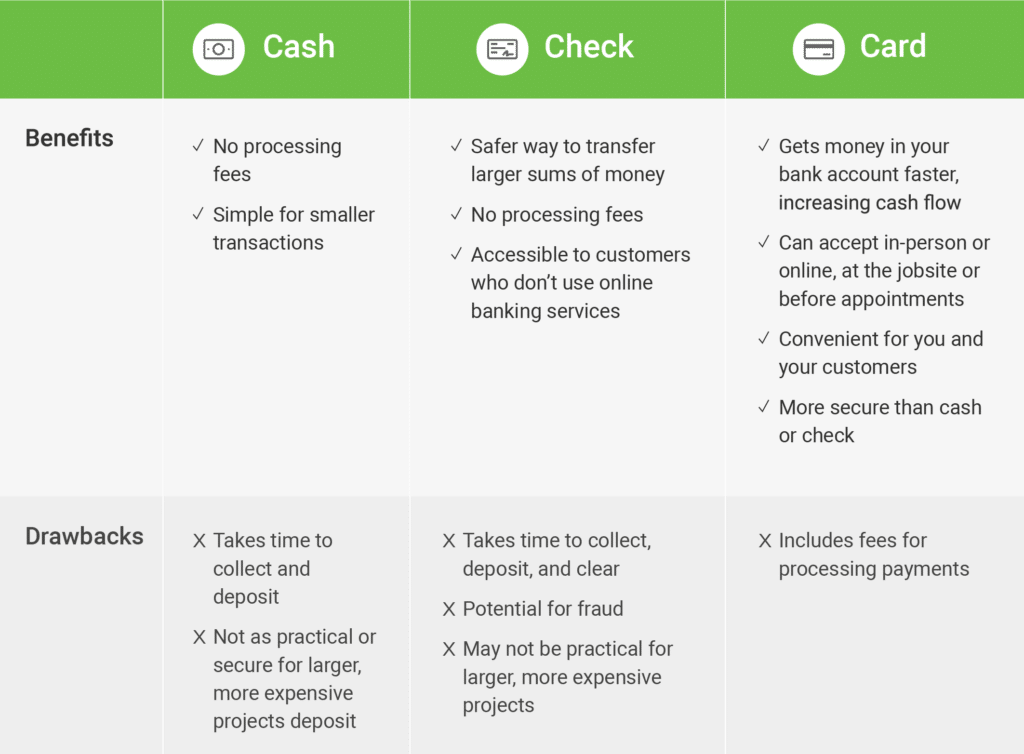

You need to understand how to accept these payments and the pros and cons of each.

Cash

As the YouGov survey suggests, cash remains popular. You may find it convenient and familiar as a business owner. Or you could see it as difficult to manage. Here are the pros and cons to consider:

Pros of cash payments

- Immediately available: You don’t have to wait for processing or check clearance.

- Fee-free: Cash does not have processing fees.

- Simplicity: You don’t need special equipment, such as a payment terminal, to accept cash.

Cons of cash payments

- Security: If cash is lost or stolen, you have no way to recover it.

- Accounting difficulties: You need to manually enter cash payments in your ledger. You can’t automate record-keeping like with card payments.

- Not ideal for large payments: Large payments could lead to additional security or documentation problems.

You may also need to plan for partial cash payments. Some clients may wish to divide payment between cash and card or check.

Checks

Paper checks are still popular. Retailers may not accept them, but people often pay bills with them. Here are the things to consider when accepting traditional checks:

Pros of check payments

- Trackable: Checks are more traceable than cash. This makes record-keeping easier.

- Safer: Checks are safer than cash. If lost, the customer can cancel and reissue the payment.

- Flexible time frame: You can let customers defer payment by dating the check for a later time.

Cons of paper checks

- Processing delay: Checks take time to process. You won’t get the funds for a day or more.

- Verification delay: You won’t know if the customer has the funds in their account.

- Manual deposits: You need to take time to collect and deposit the check. You have to visit the bank or use a bank app to deposit the money by hand.

An app for depositing checks that takes a photo of them can streamline bookkeeping.

Bank Transfers

It’s possible to forego paper and transfer money to your bank electronically. Most transfers go over the Automated Clearing House (ACH) network.

Here are the pros and cons of these traditional bank transfers:

Pros of ACH transfers

- No paper to lose: The transfer happens electronically. There is no paper check to manage or deposit.

- Convenient: You don’t have to physically pick up cash or a check. The customer can pay remotely.

- Easy record-keeping: Your bank will automatically track the payment. With the right setup, you won’t have to record the payment manually.

- Security: Transactions are encrypted.

- Lower fees: ACH transfers have an average fee of 1%, while credit card fees average 3.5%.

Cons of ACH transfers

- Processing delay: Like checks, ACH transfers take time to process. You won’t get the funds for a couple of days.

- Fees: Some banks charge processing fees for these transfers.

- Tedious process: Your customer needs to get routing and account numbers correct. A mistake will delay the transfer or send it to someone else.

Though some people prefer this method, others won’t be familiar with it.

FROM ONE OF OUR PARTNERS: Online Payments: 5 Steps to Get Started

The 4 Best Payment Options for Contractors Now

You can offer traditional payments with a bank account. However, today, small business payment options include more than cash and checks. You need to accept debit and credit cards. Also, payment apps like PayPal are increasing in popularity.

Here are four newer small business payment options you should consider as a contractor:

Credit and Debit Cards

People still use cash sometimes, but they use cards most often. A notable 70% of people prefer credit or debit cards more than other forms of payment.

And according to the EverCommerce State of the Service Economy Report, small business owners report that credit and debit cards are the most popular payment method their customers use to pay them.

You need a payment processing service to accept credit and debit cards. You can accept cards online, or you can buy a terminal to physically read the customer’s card if you’re onsite.

The processor takes a fee to verify the transaction and deposit the money into your account. These costs are 1.5% to 3.5% of the total purchase. You need to consider and plan for these fees when using this method.

Credit and debit cards are convenient for most customers. They give you a digital paper trail for the transaction. Plus, they process quickly, so you know whether or not the payment was accepted.

Mobile Payment Apps

The YouGov survey also found that payment apps like PayPal and Stripe were increasingly popular. Many people prefer to make purchases using these apps. They add a layer of security and have additional money-management tools.

You can send invoices on some apps and accept credit or debit cards or app balances.

Like credit or debit cards, apps charge a fee to process the payments. However, transfers are often instant, so you get the money right away. You can either transfer it to a bank account or spend it directly from the app.

Digital Wallets

Digital wallets like Apple Pay and Google Wallet are like physical wallets in some ways. You store cards in the wallet and use them to make payments.

Most wallets rely on mobile phones. They use QR codes and near-field communication (NFC) chips to initiate the transaction. You need a phone that reads the QR code or a payment terminal that can detect NFC signals. Despite the different ways of reading the payment info, the transaction goes just like a debit or credit card purchase.

Some people find digital wallets more convenient and secure than cards. Luckily, they are pretty easy to accept. You just need a card payment processor that can also use QR codes and NFC.

Online Payments

Customers can also pay online. You send an electronic invoice or direct them to a website.

This can be a convenient option for people to pay by a specific due date. This option usually involves processing a credit or debit card. You have to pay the processing fees. However, you don’t need a payment terminal, so it’s slightly more convenient for you.

FROM ONE OF OUR PARTNERS: What Is Payment Processing?

Ensuring Prompt Payments for Your Small Business

The right payment options can help customers pay faster. However, you can also take other steps to ensure prompt payment.

- Use automated payment systems to process payments and send invoices and reminders. This limits the time you spend chasing down payments.

- Let customers set up recurring payments to pay off their balance over time.

- Set clear payment terms on the invoice. For instance, you could charge late fees if the customer doesn’t pay by the due date.

- Use software to manage invoices. Track payments and send automatic reminders when clients don’t pay on time.

Finally, multiple payment options can help. Customers can use the method that works best for them to make payments promptly. For instance, if they don’t have funds, they can use a credit card to pay their balance.

RELATED ARTICLE: Paid in Arrears: Understanding Backward Payment Systems

3 Tips to Choose the Right Payment Options for Your Contracting Business

It can take time to set up the different small business payment options. You can take some simple steps to start the process right now. Here are three ideas to do today:

- Talk to customers. See which payment options they prefer. You can narrow down your list based on their responses.

- Check fees. Look online to learn about the fees for different payment methods. Consider how the costs will affect your pricing and budget.

- Consider integration. Look at your bookkeeping system. Can it automatically track payments from bank or card processing records? This can streamline your accounting efforts.